Digital Signature (e-Token)

Digital Signature (e-Token)

Digital Signature Certificate Services by RASP International

Unlock Secure Transactions with Digital Signature Certificates

What is digital signature (DSC)?

About Digital Signature Certificates (DSC):

Digital Signature Certificates (DSC) play a pivotal role in ensuring the security and authenticity of online transactions and communication. RASP International is your trusted partner in India for the issuance of DSCs, including Class 3, Class 3 Combo, and Class DGFT certificates, as well as the sale of e-Tokens.

A digital signature is the electronic equivalent of a physical signature and can be used to electronically sign any document or transaction. One needs to have a valid digital certificate to create a digital signature. It ensures that data or transaction is secured and is not viewed or altered by any unauthorized person. It also improves on response time taken at DGFT.

DGFT allows the filing of online applications with Class II digital signatures with an IEC number embedded in it. (n) Code, e-Mudra, and Safescrypt are approved by DGFT for issuing digital signatures. However, for purposes other than submission of the application like query or uploading/processing eBRC data, class II or above digital signature certificate issued by any approved entity of Controller of Certifying Authority of India is accepted.

Digital Signature Certificate (DSC) is a cryptographically secure key issued by certifying authorities (CAs) to validate and verify the identity of the person who holds this certificate. DSCs are predominantly issued and utilized when businesses need to digitally sign documents online, securely authenticate the Signature, and validate the signed copy.

DSC is a statutory requirement for submitting various forms to the Government of India. DSC uses public-key encryption for the creation of a signature. A digital signature certificate will be embedded in electronic documents, emails, and other digitally transmitted documents. These signatures provide and enhance security using encryption technology.

The Controller of Certifying Authority issues Digital Signature Certificates in India. The Office of the Controller of Certification Agencies (CCA) has given authority to 8 Certification Agencies to give DSCs to persons seeking the same. EMudhra is one of the Certifying Authorities that issue the Digital Signature Certificate in India.

RASP INTERNATIONAL can help you obtain an eMudhra OR any other brand Class 3 Digital Signature certificate in India with a validity of 2 years and a secure USB token. No need to submit your documents manually or through a courier because the application process will be completely online. All the Digital Signatures are provided with a FIPS-compliant ePass USB token to protect the Signature until the end of validity.

Why Digital Signature Certificates Matter:

1. Legal Validity: DSCs hold legal validity in India and are essential for various online transactions, including company registrations, income tax filings, and e-tendering.

2. Data Security: DSCs ensure the confidentiality and integrity of sensitive data by providing a secure means of electronic verification.

3. Compliance: Many government agencies and organizations mandate the use of DSCs to comply with digital documentation and filing requirements.

4. Efficiency: DSCs streamline and expedite online processes, reducing paperwork and time delays.

Our Comprehensive Services:

At RASP International, we offer a wide range of DSC services to cater to your specific needs:

1. Digital Signature Certificate Issuance:

We specialize in the issuance of Class 3, Class 3 Combo, and Class DGFT DSCs. Our experts guide you through the application process, ensuring accuracy and compliance.

2. e-Token Sales:

We provide e-Tokens separately to facilitate secure digital transactions. Our tokens are reliable and user-friendly, enhancing the security of your online activities.

3. Expert Assistance:

Our experienced team ensures a smooth and hassle-free experience. We stay updated with the latest regulations to provide you with the most current and compliant solutions.

4. Personalized Solutions:

Whether you are an individual, a small business, or a large corporation, we tailor our services to meet your unique requirements.

5. Transparent Pricing:

RASP International offers competitive and transparent pricing without hidden fees, providing you with a clear understanding of costs.

Secure Your Digital World with RASP International:

In an increasingly digital world, security and compliance are paramount. Partner with RASP International to secure your online transactions and communications with reliable Digital Signature Certificates and e-Tokens.

Contact Us:

Ready to enhance the security of your digital activities? Contact RASP International today for expert DSC issuance and e-Token solutions. We are dedicated to helping you navigate the digital landscape securely and efficiently.

Types of Digital Signature

Class 3 Digital Signature Certificate

Class 3 DSC is the most secure certificate with a signature and encryption certificate. RASP INTERNATIONAL will help you get the Class 3 DSC with an encryption certificate and a USB token; it can be used for encryption and signing. A signature certificate is used to sign a document, while an encryption certificate encrypts the data. Class 3 DSCs will be issued to individuals and companies/organizations.

Class 3 Digital Signature can be used for many purposes such as MCA e-filing, Income Tax e-filing, e-tendering, LLP registration, GST application, IE code registration, Form 16, Patent and trademark e-filing, Customs e-filing, e-procurement, e-Biding, e-Auction and more.

Class 3 DSC for Individual

RASP INTERNATIONAL can help individuals obtain a Class 3 Digital Signature with an ePass Token. The authorized person can attach DSC to documents that are submitted electronically. It guarantees the confidentiality and validity of electronically supplied records.

Class 3 DSC for Company/Organization

Class 3 DSC is valid for companies, NGOs, trusts, government departments, and organizations. RASP INTERNATIONAL can help you obtain an eMudhra Class 3 Digital Signature certificate in India with two-year validity and a secure USB token.

DSC will be issued in the Company’s name; this proves the user’s right on behalf of the company and contains personal and Company details. Class 3 DSC for Company is issued to authorize the signatory of any company.

Renewal of Class 3 DSC

According to Controller of Certification Agencies (CCA) guidelines, renewing Digital Signatures requires fresh identity verification. You can renew your Class 3 DSC by following the same process as buying a new Digital Signature Certificate on the RASP INTERNATIONAL website.

Documents Required for Digital Signature Certificate (DSC)

A Digital Signature Certificate (DSC) is a secure digital key that is issued by the certifying authorities to validate and certify the identity of the person holding this certificate. Now, DSC is a statutory requirement for submitting various forms to the Government of India.

The applicant must submit the required documents to the certifying authorities to obtain a digital signature certificate. The types of documents required for DSC differ based on the applicant type. In this article, we provide a comprehensive list of Documents Required for a Digital Signature Certificate (DSC) in India.

Digital Signature Certificate (DSC)

A Digital Signature Certificate (DSC) is the equivalent of a physical signature in an electronic format, as it establishes the identity of the sender of an electronic document on the Internet. It’s mandatory for Company Registration, GST Registration, Trademark Registration, Income Tax Filings, and Many other Government Forms like Tenders.

Documents Required for Digital Signature Certificate (DSC)

The Documents Required for DSC are mainly classified into four categories, which are as follows:

- Documents Required for Indian Nationals

- Documents Required for an Indian Organization

- Documents Required for Foreign Nationals

- Documents Required for Foreign Organization

Documents Required for Indian Nationals

The following documents are required to get a Digital Signature Certificate (DSC)

Identity Proof

The applicant can submit any one of the following documents as Identity Proof:

- Aadhar Card (eKYC Service)

- Passport

- PAN Card of the Applicant

- Driving Licence

- Post Office ID Card

- Bank Account Passbook containing the photograph and signed by an individual with attestation by the concerned Bank official

- Any Government-issued photo ID card bearing the signatures of the individual

- Photo ID card issued by the Ministry of Home Affairs of Centre (MHA) or State Governments

Address Proof

- Aadhar Card (eKYC Service)

- Telephone Bill

- Voter ID Card

- Driving Licence (DL)/Registration Certificate (RC)

- Water Bill – Not older than 2 months

- Electricity Bill – Not older than 2 months

- Latest Bank Statements signed by the bank – Not older than 2 Months

- GST registration certificate

- Property Tax or Corporation or Municipal Corporation Receipt

- Any Government photo ID having a Name and address

Documents Required for Indian Organization

Documents Required for Indian Organizations are listed as follows:

Company

- Copy of Organizational PAN Card, If GST number is not provided

- Copy of Recent Bank Statement / Bank Certificate, If GST number is not provided

- Copy of Incorporation, If GST number is not provided

- Proof of Authorized Signatory – List of Directors / Board Resolution Self-attestedAuthorized Signatory ID Proof – Organizational ID Card / PAN Card / etc

- Copy of Applicant PAN Card

Partnership Firm

- Copy of Organizational PAN Card, If GST number is not provided

- Copy of Recent Bank Statement / Bank Certificate, If GST number is not provided

- Copy of Partnership deed containing a list of Partners / Authorization Letter

- Authorized Signatory ID Proof – Organizational ID Card / PAN Card / etc

- Copy of Applicant PAN Card

Proprietorship

- Copy of Recent Bank Statement / Bank Certificate, If GST Number is not provided

- Copy of Business Registration Certificate – Shop and Establishment (S&E) /etc

- Authorized Signatory ID Proof – Organizational ID Card or PAN Card

- Copy of Applicant PAN Card

AOP / BOI – An association of persons or a body of individuals

- Copy of Organizational PAN Card, If GST number is not provided

- Copy of Recent Bank Statement / Bank Certificate, If GST number is not provided

- Copy of Incorporation, If GST number is not provided

- Proof of Authorized Signatory – List of Directors / Board Resolution / Resolution

- Authorized Signatory ID Proof – Organizational ID Card / PAN Card / etc

- Copy of Applicant PAN Card

Limited Liability Partnership (LLP)

- Copy of Organizational PAN Card, If GST number is not provided

- Copy of Recent Bank Statement / Bank Certificate, If GST number is not provided

- Copy of Incorporation, If GST number is not provided

- Proof of Authorized Signatory – List of Directors / Board Resolution / Resolution

- Authorized Signatory ID Proof – Organizational ID Card / PAN Card / etc

- Copy of Applicant PAN Card

Non-governmental organization/Trust

- Copy of Organizational PAN Card, if GST number not provided

- Copy of Recent Bank Statement / Bank Certificate, If GST No. not provided

- Copy of Incorporation, if GST number not provided

- Proof of Authorized Signatory – List of Directors or Board Resolution or Resolution

- Authorized Signatory ID Proof – Organizational ID Card / PAN Card / etc

- Copy of Applicant PAN Card

Documents Required for Foreign Nationals

The Foreign National needs to submit the following documents:

Identity Proof

The following documents are mandatory for getting the DSC.

- Attested copy of Applicant’s Passport

- If the applicant is out of a foreign country- An attested copy of the VISA

- If the applicant is in India – An attested copy of the Resident Permit certificate

Address Proof

The following documents are mandatory for getting the DSC

- Attested copy of Applicant’s Passport

- Attested copy of any other Government issued Address Proof

Documents Required for Foreign Organization

Identity Proof (All are mandatory) | Address Proof (All are mandatory) |

|

|

Foreign Attestation

The identity and address proof of foreign nationals must be attested by the following authorities:

- Embassy of Native Country (If the applicant is not a citizen of India)

- Apostilized by Native Country, after Public Notary (if the country is in Hague Convention)

- Consularized by Native Country, after Public Notary (if the government is not in Hague Convention)

General Instructions

Follow the general instructions listed below while furnishing the digital signature application form:

- The signature of the applicant should be in Blue Ink only

- The signature of the applicant should be as it is in the Identity Proof

- A photo of the applicant in the application form should be signed by the applicant

- All supporting documents should be attested by either of Gazetted Officer / Bank Manager / Post Master

- For proof of attesting officer, either one of the below is mandatory –

- Contact Details of the Attesting Officer including the name, designation, office address, and contact number. This should be part of the attestation. If provided separately, it should be attested either by the Applicant or Attesting Officer; or

- Self-Attested copy of the Organizational Identity card of the Attesting Officer

- Organizational Documents can also be attested by an Authorized Signatory. However, if the taxpayer fails to get the Organizational Documents attested by the authorized signatory, in such cases an attested copy of the organizational ID card of the authorized signatory is mandatory.

How to create a digital signature create digital signature How to get a digital signature How to add a digital signature in pdf How to verify the digital signature How to validate the digital signature How to validate digital signature in pdf How to do a digital signature How to get a digital signature dsc signature What is a digital signature certificate? digital signature India signature India e signatures in India emudra How to renew DSC Digital signature price buy digital signature

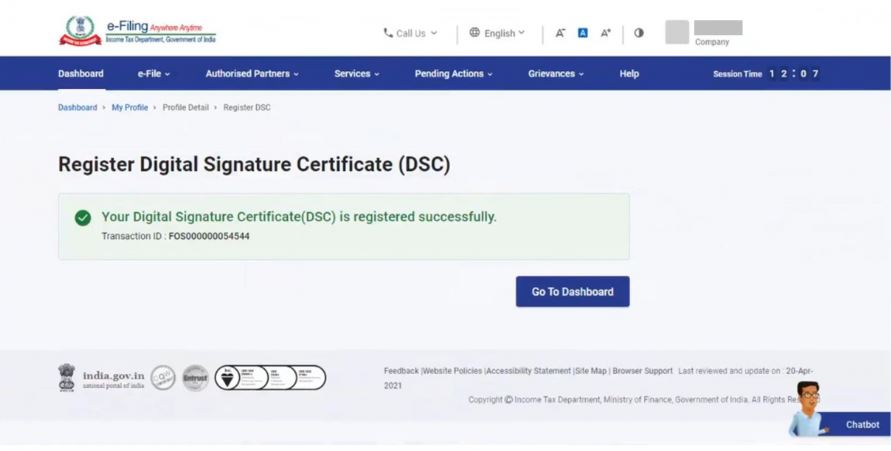

Register DSC on the new Income Tax Portal

Digital Signature Certificate or DSC is proof of the identity of an individual taxpayer or organization. Irrespective of the authentication, each digital taxpayer must register DSC on the new Income Tax Portal.

A valid Class 3 Digital Signature Certificate (DSC) is essential for taxpayers to file Income tax returns online because it has to be affixed to all documents filed in the ITR. Registering the DSC on the new Income Tax Portal ensures that the returns submitted are authentic and secure. The present article briefs the procedure Register DSC on the new Income Tax Portal.

Digital Signature Certificate (DSC)

DSC is the electronic version of a physical certificate. It’s used to examine someone’s or an organization’s identity online. Likewise, a handwritten signature confirms a physical document, Digital Signature Certificate (DSC) confirms an electronic document. Digital Signature Certificate can also use to e-verify a taxpayer’s ITR, among other things.

Importance of Registering DSC on the Income Tax Portal

Any person willing to sign the Income Tax Return ‘digitally’ has to complete the registration process for the DSC on the e-filing website before signing.

- As mentioned above, Digital Signature Certificate (DSC) is essential for taxpayers to file Income tax returns online. It ensures that the ITR submitted is secure.

- DSC must be affixed on all documents filed in the Income Tax Returns.

Who should register the DSC on the Income tax portal?

- Companies and taxpayers must use a Digital Signature Certificate (DSC) to e-verify their ITR (Income Tax Return).

- DSC is mainly for those taxpayers whose accounts are to be audited under section 44AB of the income tax act, and it is optional for the rest of the taxpayers.

- As per the revised provisions under section 44AB of the Income Tax Act, e-Filing is mandatory for all individuals/professionals having an annual gross receipt of Rs.25 Lakhs and above and for businesses with an annual turnover of Rs.1 Crore and above.

e-Filing of Income Tax with Digital Signature Certificate

A Digital Signature Certificate is mandatory for income tax e-filing by a specific section of businesses, families, and individuals.

As per Section 140 of the Income Tax Act 1961, the following person is responsible for signing the IT return.

- Managing Director

- Any other Director (in case the MD is unavailable)

- Any authorized person possessing a legal power of attorney in case of the presence of a Non-resident Company

- Managing Partner of an organization or any other Partner (in the specific case of Managing Partner being unavailable)

- Chief Executive Officer/ Principal Officer or Competent person in case of other entities such as Body of Individuals, Association of Persons, Artificial Juridical person, Trust, Local Authority

- Karta, in case of a HUF

- Self in case of an Individual

- Any authorized person possessing a legal power of attorney if the individual cannot sign the IT Return

- Any authorized person possessing a legal power of attorney if the individual is outside India.

Note: Any person can change or update their DSC registration any number of times.

For individuals and businesses not covered by the latest mandate, a Digital Signature Certificate assures greater convenience while filing IT returns and greater security during any electronic transactions.

Register Digital Signature Certificate (DSC) service of Income tax Portal

The Register Digital Signature Certificate (DSC) service of the Income-tax Portal is available to all registered users of the Income tax e-Filing portal. This service enables the registered taxpayer to perform the following:

- Register DSC

- Re-Register when registered DSC has expired

- Re-Register when registered DSC has not expired

- Register DSC of Principal Contact

Register DSC on New Income Tax Portal

CBDT launched the new Income Tax portal on 07th June 2021; taxpayers were required to register Digital Signature Certificate (DSC) in the new Portal even though it was registered earlier.

- All taxpayers who wish to use DSC are required to re-register their DSC on the new Income tax portal using the ‘Register DSC’ service.

- CBDT informed that the DSC registered on the previous Income tax e-filing portal will not be migrated to the new e-filing Portal due to security and technical reasons.

Prerequisites for Register DSC on the new Income Tax Portal

- The taxpayer must be the registered user of the e-filing portal with a valid username and password.

- Downloaded and installed the emsigner utility

- USB token should plug into the computer

- DSC USB token should be Class 3 DSC

- The registered DSC should be active and not expired.

- DSC should not be revoked

Procedure to download the emsigner utility

The emsigner utility must download before registration of DSC in the Income-tax Portal. Follow the below-mentioned steps to download the emsigner utility:

- Access the official website of the income tax e-filing portal and Click on the ‘Downloads’ tab from the top.

- Click on ‘DSC Management Utility’ and select the ‘Utility (emBridge) link.

- After the completion of downloading, install the emBridge on the computer.

Procedure to Register DSC on the new Income Tax Portal

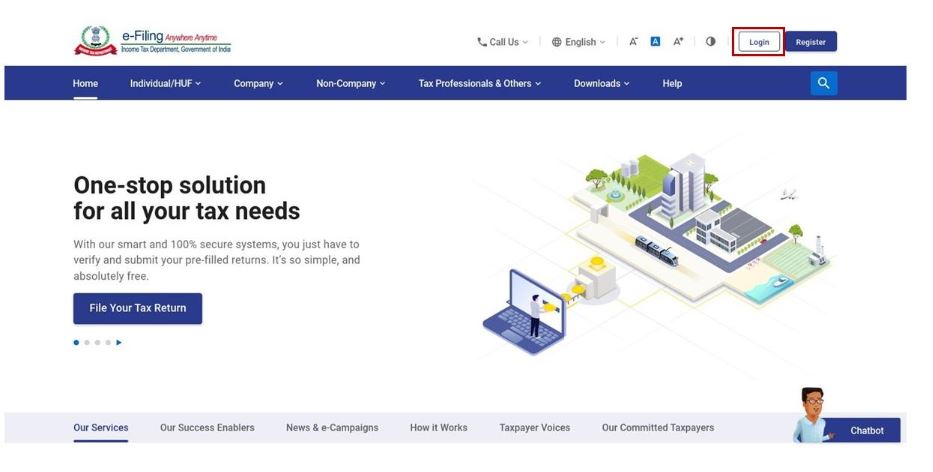

- Access the official website of the new Income tax e-Filing portal and log in to the Portal using valid user credentials.

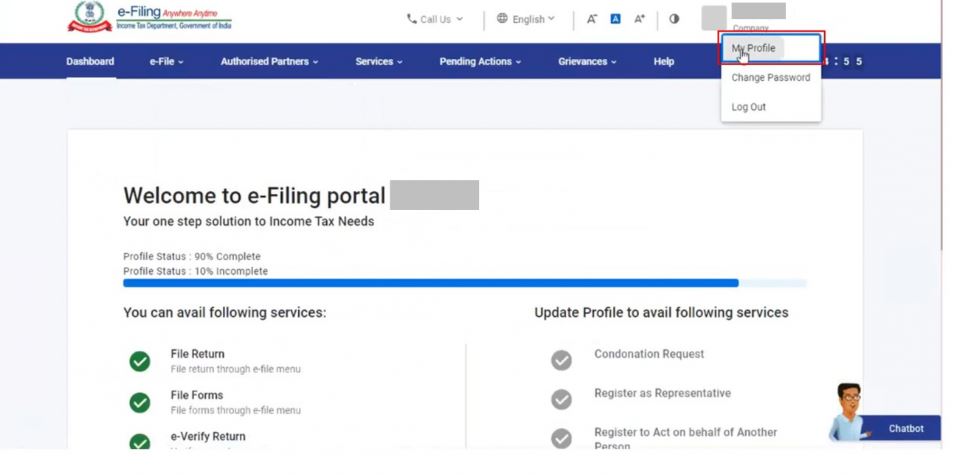

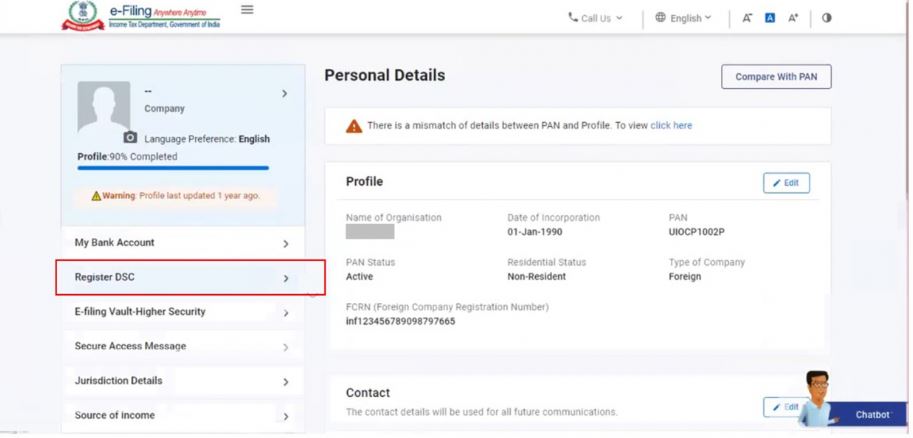

- Select the My Profile page from the Dashboard and Click Register DSC on the left side of the screen.

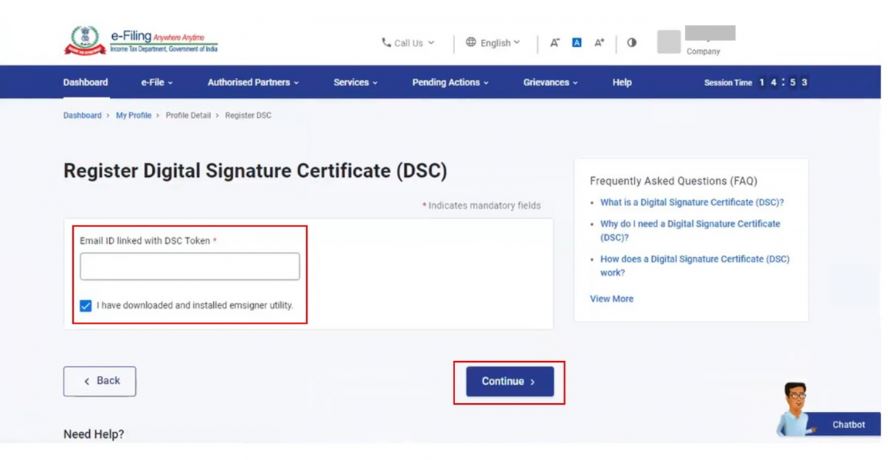

- Furnish the email ID linked with the DSC token.

- The PAN number will display, and select “I have downloaded and installed emsigner utility” and Click on Continue.

- Insert the USB token into the USB port of the machine and run the “eMBridge.”

- Select the Provider in the Dropdown (Provider will display after the successful running of the eMBridge application, Select the Certificate from the dropdown (DSC holder name will show in the dropdown)

- Furnish the Provider Password, the DSC token password, and click on “Sign.”

- A success message will display on successful validation.

Note:

- In case the DSC is expired, the system will display a message that ‘Your registered DSC has already expired. Please re-register a valid DSC’.

- If a taxpayer wants to re-register an unexpired DSC, click on ‘View’ to view the details or click on ‘Update’ to update the same.

- If the taxpayer wants to register the DSC with the principal contact, enter the email ID of the principal contact registered at the e-filing portal and proceed to register DSC.

Update DSC on the Income Tax Portal

Updating a DSC is similar to registering a DSC with the income tax portal. Follow the steps mentioned above; on completion of the selection of DSC, click on “Update” to update the Digital Signature Certificate.